MS-4 December, 2015

MANAGEMENT PROGRAMME

Term-End Examination December, 2015

MS-4 : ACCOUNTING AND FINANCE FOR MANAGERS

Time : 3 hours Maximum Marks : 100

Note : (i) Attempt any five questions.

(ii) All questions carry equal marks.

(iii) Use of calculators is allowed.

1. (a) Explain the 'Accrual Concept' and the 'Consistency Concept' in accounting and signify their importance to an accountant.

(b) Distinguish between 'Operating Profit' and 'Net Profit'. Which is a measure of operational efficiency of a company ? Distinguish between Capital expenditure and Revenue expenditure. Which is taken

into account for determining the Operating Profit ?

2. What do you understand by Fund Flow Statement ? How does it differ from a Cash Flow Statement ? Explain the main items which are shown in the fund flow statement and the purpose of preparing this statement.

3. What do you understand by Discounted Cash Flow Techniques of Capital Budgeting ? Briefly

explain the Net Present Value Method and Internal Rate of Return Method of appraisal of

projects. Which of the two would you rank better and why ?

4. Distinguish between :

(a) Profitability Index and Profitability Ratios.

(b) Earnings Yield and Dividend Yield.

(c) Fixed Budget and Flexible Budget.

(d) Direct Labour Rate Variance and Direct Labour Efficiency Variance.

5. Explain the following statements, giving reasons :

(a) Debt is a double-edged weapon.

(b) Depreciation acts as a Tax Shield.

(c) Fixed Costs are variable per unit and Variable Costs are fixed per unit.

(d) When the use of operating and financial leverages is considerable, small changes insales will produce wide fluctuations in Return on Equity and E.P.S.

6. "Zero-based Budgeting provides a solution for overcoming the limitations of a traditional

budget". Explain this statement and describe the process of preparing a Zero-based Budget.

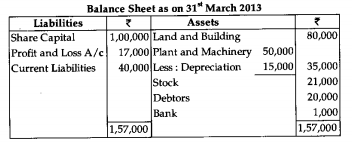

7. Following is the abridged Balance Sheet of ABC Company Ltd. as on 31st March 2013.

With the help of additional information given below, you are required to prepare Profit and Loss

Account and a Balance Sheet as on 31st March 2014.

(a) The Company went in for re-organisation of capital structure with the share capital

remaining the same but other liabilities were as follows :

Share Capital 50%

Reserves 15%

5% Debentures 10%

Trade Creditors 25%

Debentures were issued on 1st April, interest being paid annually on 31st March.

(b) Land and Buildings remain unchanged. Additional Plant and Machinery has been purchased and a further depreciation (f 5000) written off.

(The total fixed assets then constructed 60%of the total gross fixed and current assets.)

(c) Working Capital Ratio was 8 : 5.

(d) Quick Assets Ratio was 1 : 1

(e) Debtors (4/5th of quick assets) to sales ratio revealed a credit period of 2 months. There

were no cash sales.

(f) Return on Net Worth was 10%.

(g) Gross Profit was @ 15% of sales.

(h) Stock Turnover was eight times for the year ignore taxation.

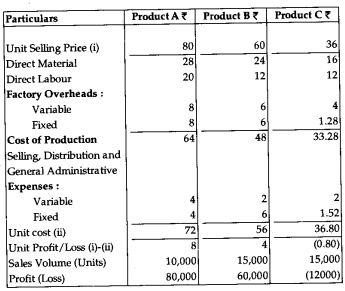

8. While finalising the plans for the Coming Year the excutives of XYZ Co. Ltd. thought that it will be advisable to have a look at the product-wise performance during the current year. The

following information is furnished :